.png)

When looking at your accounting firm’s business development, it’s a good idea to first look at where the industry is going.

The U.S. Bureau of Labor Statistics, when examining the accountancy sector, determined that “a 4% job growth is projected in the period of 2019–2029“.

When combined with another report by AICPA stating that “82% of CPAs claim they’re not future-ready,” the issue is clear.

How do you balance growth while competing with more technologically developed accountants and delivering great service at scale?

I've put together some techniques to improve your accounting firm’s business development, embrace change and find that balance.

But what is business development for an accounting firm?

Essentially, it’s anything that helps accounting professionals build relationships with prospects and clients that result in generating opportunities and sales.

"Business development is anything that helps accountants build relationships with prospects and clients that result in generating opportunities and sales."

You should know that the business development of an accounting firm shouldn’t just focus on outbound and inbound marketing.

The key is to look at how to leverage the power of:

There are lots of ways to grow in a crowded marketplace.

But you’re probably wondering, “are these techniques relevant to my accounting firm?” Depending on the prices you offer in relation to the quality of service, your customer will perceive the value they're getting differently.

Considering where you stand in the value matrix, there are two primary ways to develop your accounting business:

Although it can be slower than other methods, it’s the safest and most viable way to grow. With the right people, technology, and some time on your hands, organic strategies are often more manageable and "safer."

They're also the most straightforward to execute. That's because organic growth focuses heavily on keeping existing business in and growing bit by bit:

Pursuing organic growth is a natural process for most accounting firms, however there are times where using paid advertising makes sense.

The "problem" with organic growth is that the more you hold onto an existing customer the higher their expectations grow. That has to be matched with increases in hourly rates, contract revisions, or new contracts altogether.

When you design a complete go-to-market strategy instead, your marketing budget can be allocated to specific offers that are designed to capture targeted audiences at scale, leading to significant business results.

There's no right or wrong way; however if you're not confident in your backend processes, you'll want to focus on that first before you go "out there" in the wild without knowing what needs to happen in the background.

If you already have processes in the background you're confident about, and have been profitable for a while - advertising is absolutely a viable (and sometimes necessary) path to growing your accounting business.

It's worth noting that advertising requires a lot of upfront budget both in time and money. So it's not something that a family business just starting out will want to consider unless the profits are truly significant.

I'm going to focus on organic growth for this post but depending on your situation, advertising is a viable option to develop your business at scale.

Innovative business development needs to incorporate strategies that harness the power of people, automation, workflows, and communication.

The simplest, most sustainable and manageable way to do that is through organic growth. Lack of planning and failure to develop the right backend processes using inappropriate technology can lead to disaster.

Why?

Because customers aren't one-dimensional.

However, the way service processes tend to be structured often is due to the complexity of capturing all the possible variables of client behavior.

That's where the inherent risk lies:

» Spending time and effort developing processes and workflows that aren't actually fit for purpose and that ultimately fail to deliver."

This problem can only be fixed with problem solving targeted specifically at accounting firms and backed by design and development skills.

Bringing that talent in-house is expensive.

So here's a structure that will help...

To develop a small accounting firm effectively, you need to define what your ideal customer needs done first, brainstorm those steps together with your team, and implement them one by one with existing customers.

The problem isn't necessarily coming up with the process but rather ensuring that it works again, and again, and again.

“Reliability becomes a crucial aspect of running your business when you start counting on procedures to get things done”.

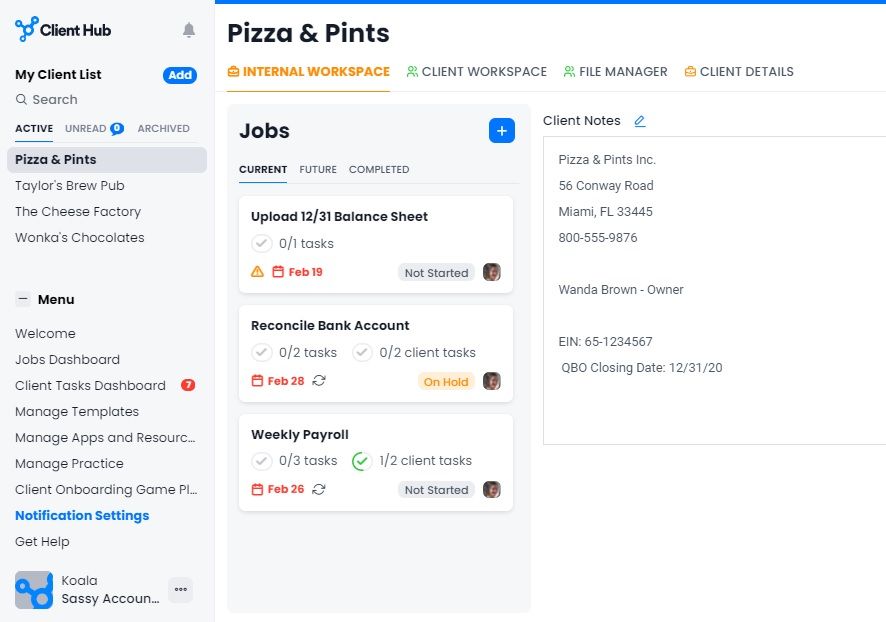

That's where accounting workflow tools like Client Hub make for an experience that isn't powered by a constant worry that something, somewhere will eventually go wrong with the procedure.

A common consequence of developing a process without much thought is spending more time troubleshooting why that process isn't working well rather than dedicating your time to what customers truly care about.

So the ideal structure to develop your business is:

If you're interested to know how each of these pieces go together into one experience, check out this all-in-one workflow guide for accounting firms.

Now that I've covered some of the big picture considerations for an accounting firm's business development, let’s drill deeper in the day-to-day:

A question often asked is:

Do automated business development workflows increase profitability? Will they really help me develop my accounting firm’s business?

Based on existing research:

When the value of using cloud technology is shifted from your end all the way down to the customer, they are willing to pay more, and you gain an advantage in terms of efficiency and productivity.

Some of the common workflows for accounting firms are:

For example, you can create automations to:

Here's an example of a QuickBooks integration that is saving Client Hub's customers a ton of time categorizing expenses.

To grow in a large, competitive marketplace, it’s essential to establish clear policies and procedures for internal purposes.

“From compliance to managing risk, having the entire organization aligned and with their mind set on the same things is key to success.”

For example, offering added value advisory services may be one of your unique selling points.

To do this at scale, you will need a platform that gives partners access to these processes so that they are aligned on how they need to happen.

Research from Sage suggests that, “67% of accountants feel that the industry has become more competitive than before.”

A great way to differentiate yourself and increase the value of your sales pitch is to ditch traditional file sharing methodologies such as email and embrace the idea of developing a client hub.

Client relationship management is at the heart of any accounting firm's business development. For truly-outstanding organic growth, you need to consider the full client experience:

To do this well, you need a secure, collaborative platform with client communication workflows built-in. It needs to give clients access to their reports in one place and allow for integration into other systems.

Increasing profit margins is key to any accounting firm's business development. You’ve probably come across the Pareto Principle.

“Using tools that have the workflows to cover that 80% is immeasurably valuable as it prevents you from having to deal with the complexity of it.”

Managing demand to make more informed decisions is a master skill that can’t be achieved productively today without the right technology.

Cloud tools like Client Hub are built from the ground up to consider the entire accounting workflow - from the backend to the frontend.

This will help cover customers that need constant input by allowing them to self-serve, and help you focus on those that deliver the higher value instead.

To grow your business, grow your people.

Whether you are support staff or a third-party partner, everyone should be engaged in your accounting firm’s business development.

Using data from a cloud accounting system helps you to support and focus on training and coaching programs in:

Investing in up-skilling is also cheaper, tailored and less risky than hiring fresh talent. Developing talent needs serious consideration in all accounting firm’s business development strategies.

A thorough business development process focuses on organic growth and maximizes people, processes, communication, and technology.

Introducing a client hub and automating your most tedious accounting workflows is an almost instant benefit to your business development efforts.

Client Hub does just that and more. It provides an all-in-one client collaboration and internal workflow solution for you to achieve long-term success with your accounting firm. Try it out for 14 days here »

It is a strategy that focuses on people, processes, communication, and I.T. to nurture relationships and develop opportunities with clients and prospects. This helps an accounting firm increase sales and revenue sustainably.

Some of the common services accounting firms provide are: Managing taxes, Payroll, Bookkeeping, Wealth management, Bank reconciliations, Business advice, and; Financial planning

Through focusing on building positive client relationships while retaining existing business. Techniques for this include: Using a CRM and cloud accounting workflow platform to boost productivity, Development of staff to grow the business, Creation of a powerful brand, and more.